Navigating the world of business financing can be complex, but with Apex Business Solutions, it’s streamlined and user-friendly. Whether you’re looking to boost your business credit, secure funding, or enhance your online presence, our process is designed to guide you every step of the way. Here’s how you can get started.

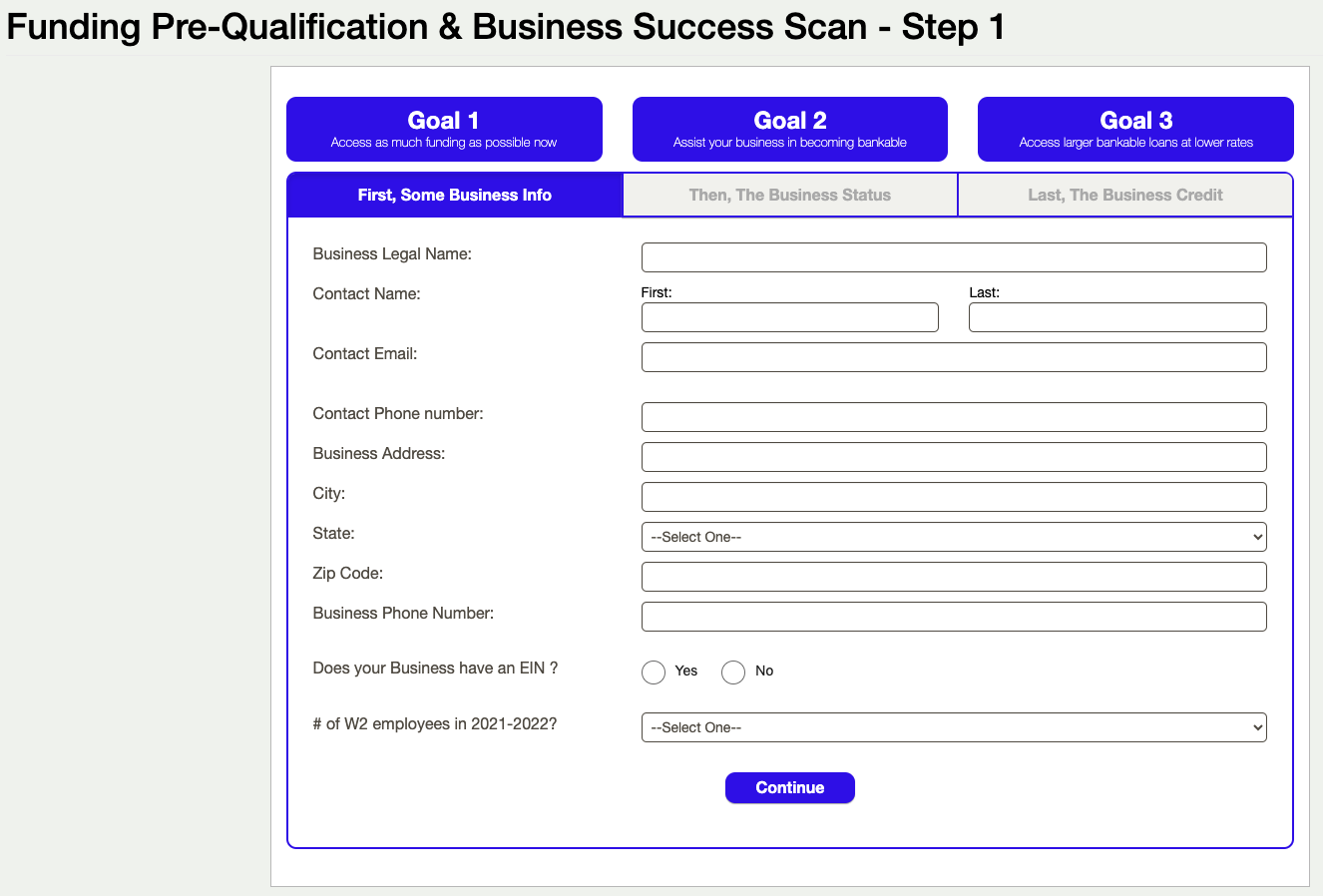

Step 1: Complete the Business Scan

- What It Is: Our Business Scan is your first step towards financing. It assesses 150 data points related to your business, including financing, credit, lender compliance, and your online footprint (SEO, star ratings, local listings, etc.).

- What You Get: After completing the scan, you’ll receive a comprehensive report showing what you pre-qualify for and a step-by-step guide to optimize each aspect of your funding pre-qualification.

- Getting Started: Once you complete the scan, you’ll be emailed a unique username and password to access our platform.

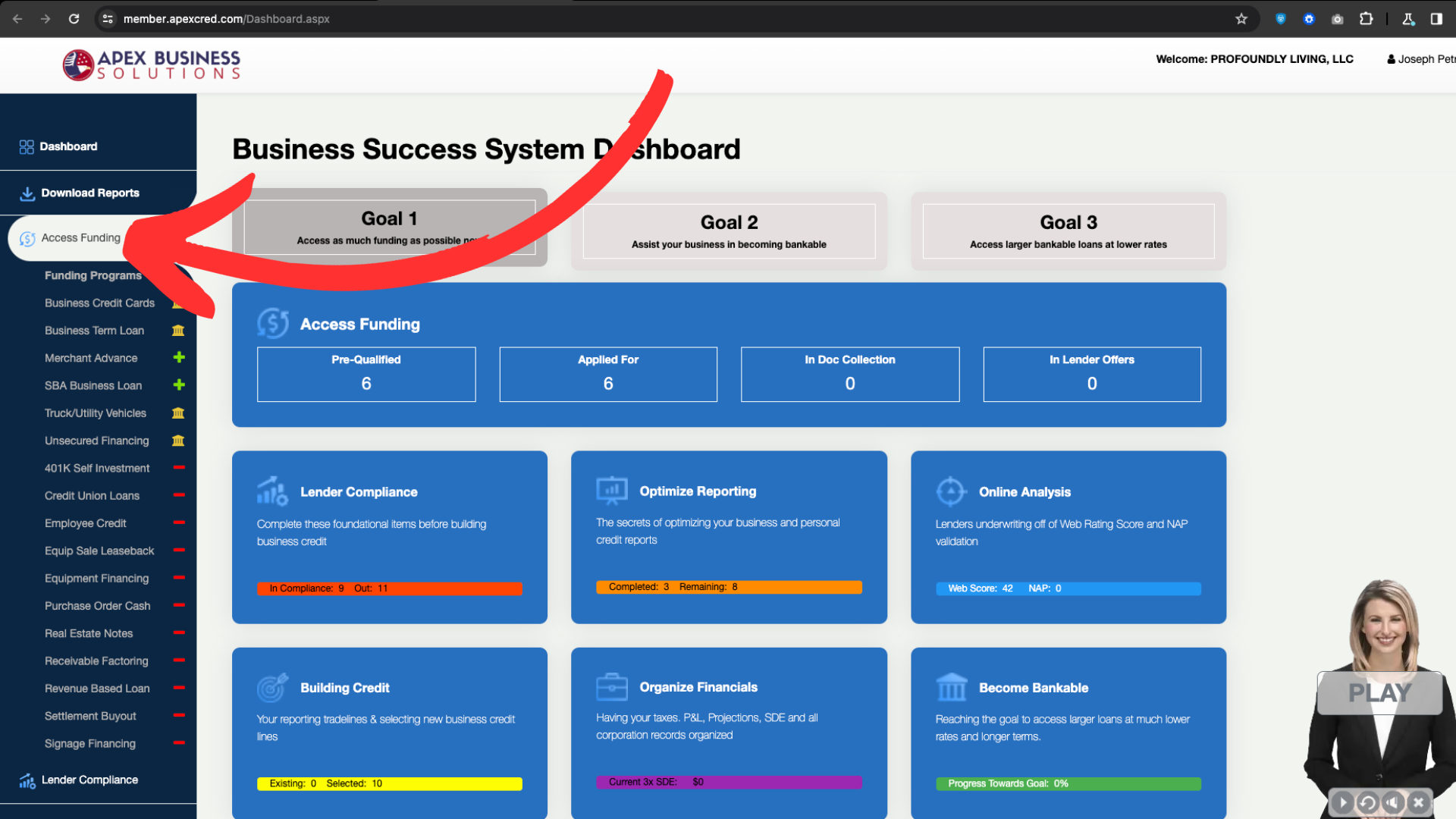

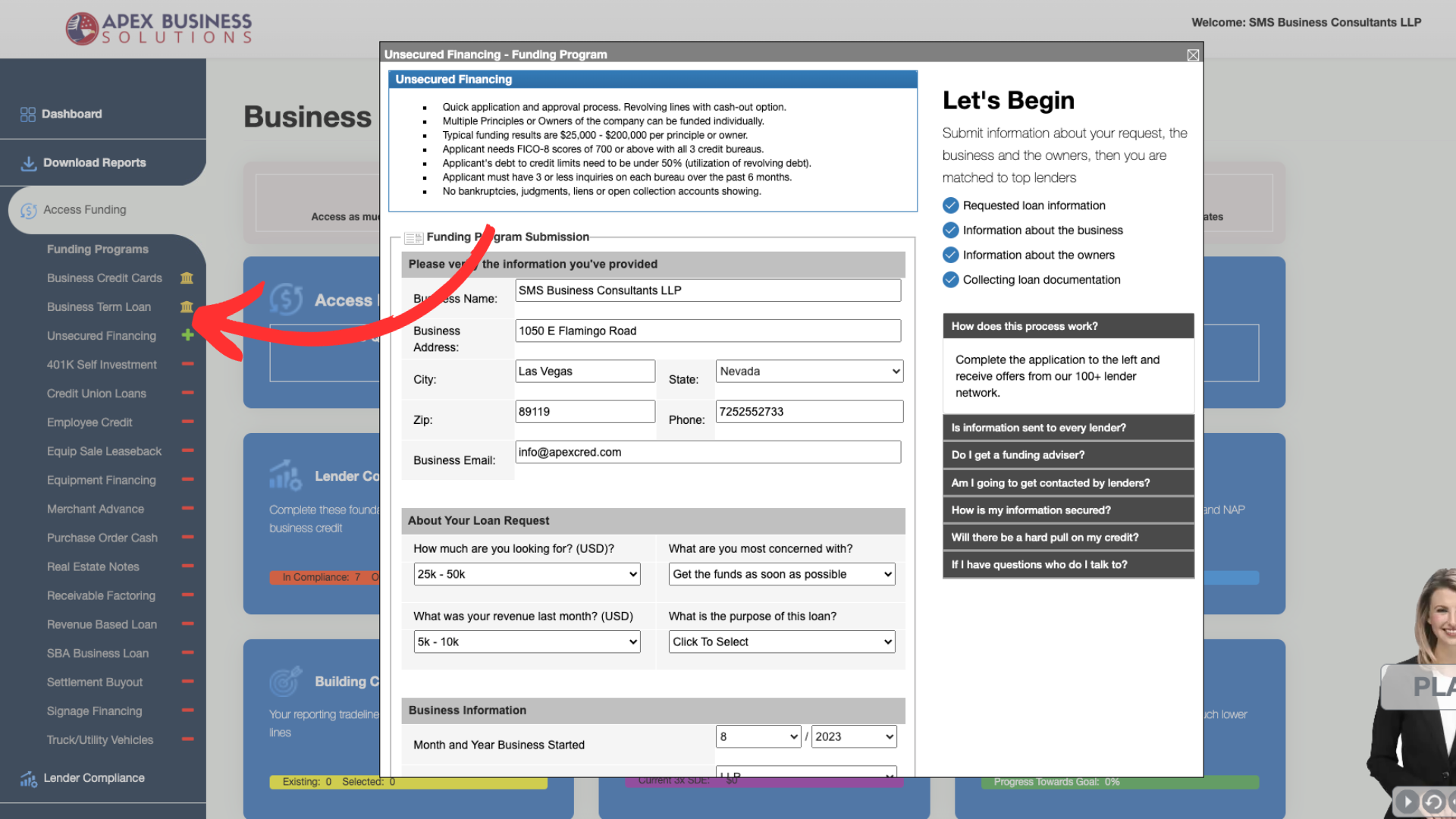

Step 2: Apply for Pre-Approved Funding

- Accessing Funding Options: Log in to your account and click on the “Access Funding” tab. This will display the funding products you prequalify for.

- Application Process: We recommend applying for all pre-qualified options. After applying, a funding agent will contact you to guide you through the next steps, including document collection. Note: There are no hard credit pulls at this stage.

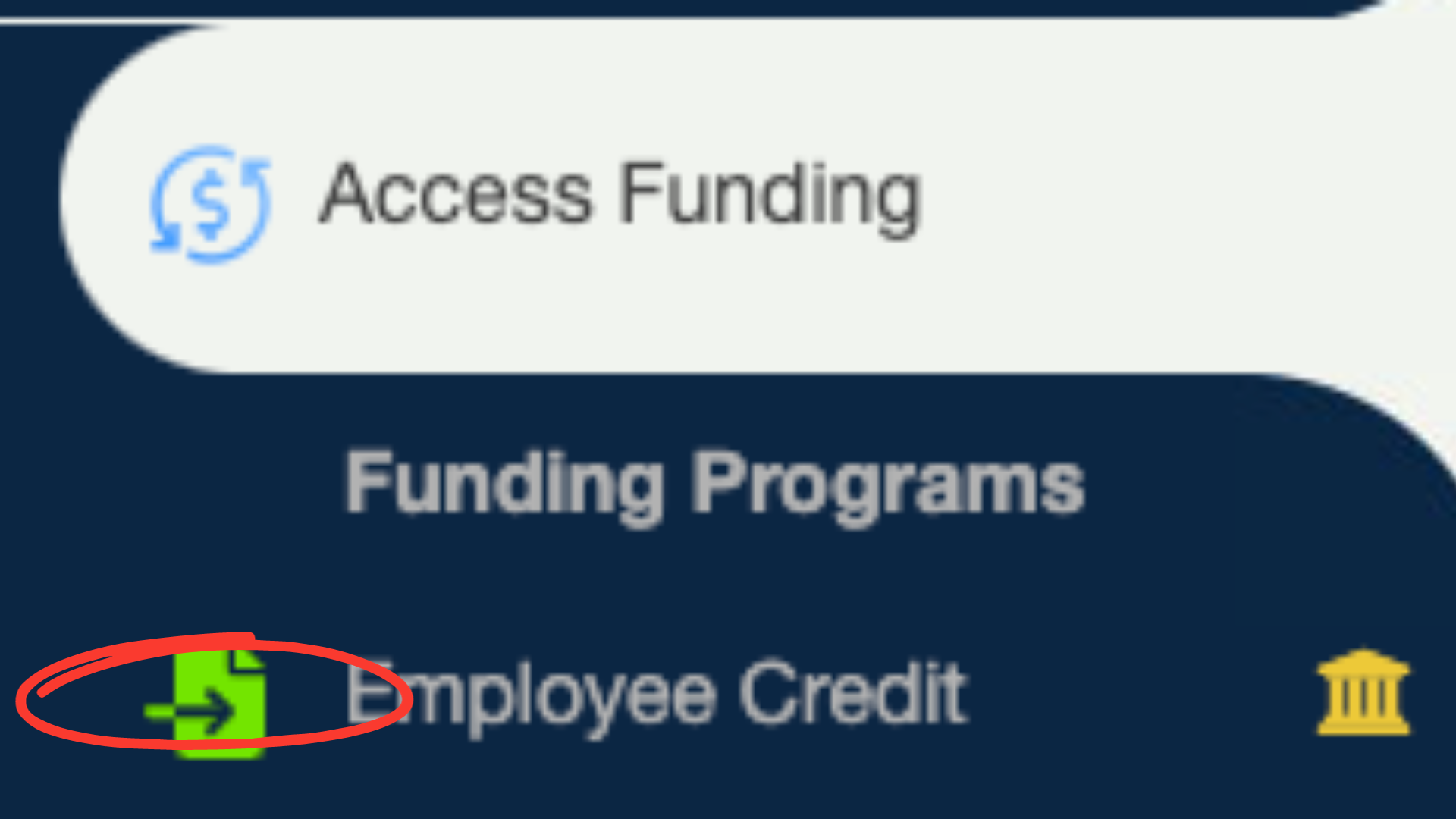

Step 3: Document Collection

- How to Proceed: For each funding option you’ve applied for, a green icon will appear. Click on these icons to upload the requested documents.

Step 4: Building Your Funding Packet

- What Happens Next: Our funding agent compiles your information and documents into a funding packet, which is then sent to our network of over 250 lending partners.

Step 5: Receiving Offers

- The Advantage of Apex: Unlike traditional lending, where you’re at the mercy of a single bank’s decision, Apex puts you in control. Our lending partners will send you multiple offers, allowing you to choose the best rates and terms for your business.

Step 6: Receiving Funds

- Timeline: The funding process typically takes 14-30 days, though it can sometimes be quicker. Once you select an offer, the funds will be disbursed to you.

Conclusion: Applying for business financing doesn’t have to be daunting. With Apex Business Solutions, you’re guided through a clear, straightforward process that not only helps you secure funding but also strengthens your business’s financial foundation. Start with our Business Scan today and take the first step towards your business’s financial success.